Retirement Architects Weekly Market Review: March 7th, 2025

Weekly Market Report: March 7th, 2025

Last week markets took in a healthy dose of policy uncertainty with on and off again tariff news driving risk appetite while most economic reports came in largely as expected. Dovish leaning narratives from Fed policy makers managed to calm markets slightly but U.S. equity markets closed the week down 3.1% while developed international (+2.4%) and emerging markets (+2.9%) both managed healthy gains thanks in large part to a notable 3.5% decline in the USD. Bonds didn’t fare much better as interest rates ticked slightly higher and the yield curve steepened leaving the 10yr UST yield at 4.32% while credit spreads widened again marginally on the week, from 287 to 299.

Market Anecdotes

- Markets are in the process of absorbing material changes in trade policy and a rare attempt at addressing the size and scope of government, both resulting in a dense pack of policy fog.

- The chaotic trade war on Canada, Mexico, and China was a key driver behind markets last week resulting in a fall in equity markets and a rally in bond markets – two markets that clearly remember the economic impact of 1930’s era Smoot Hawley Tariff Act.

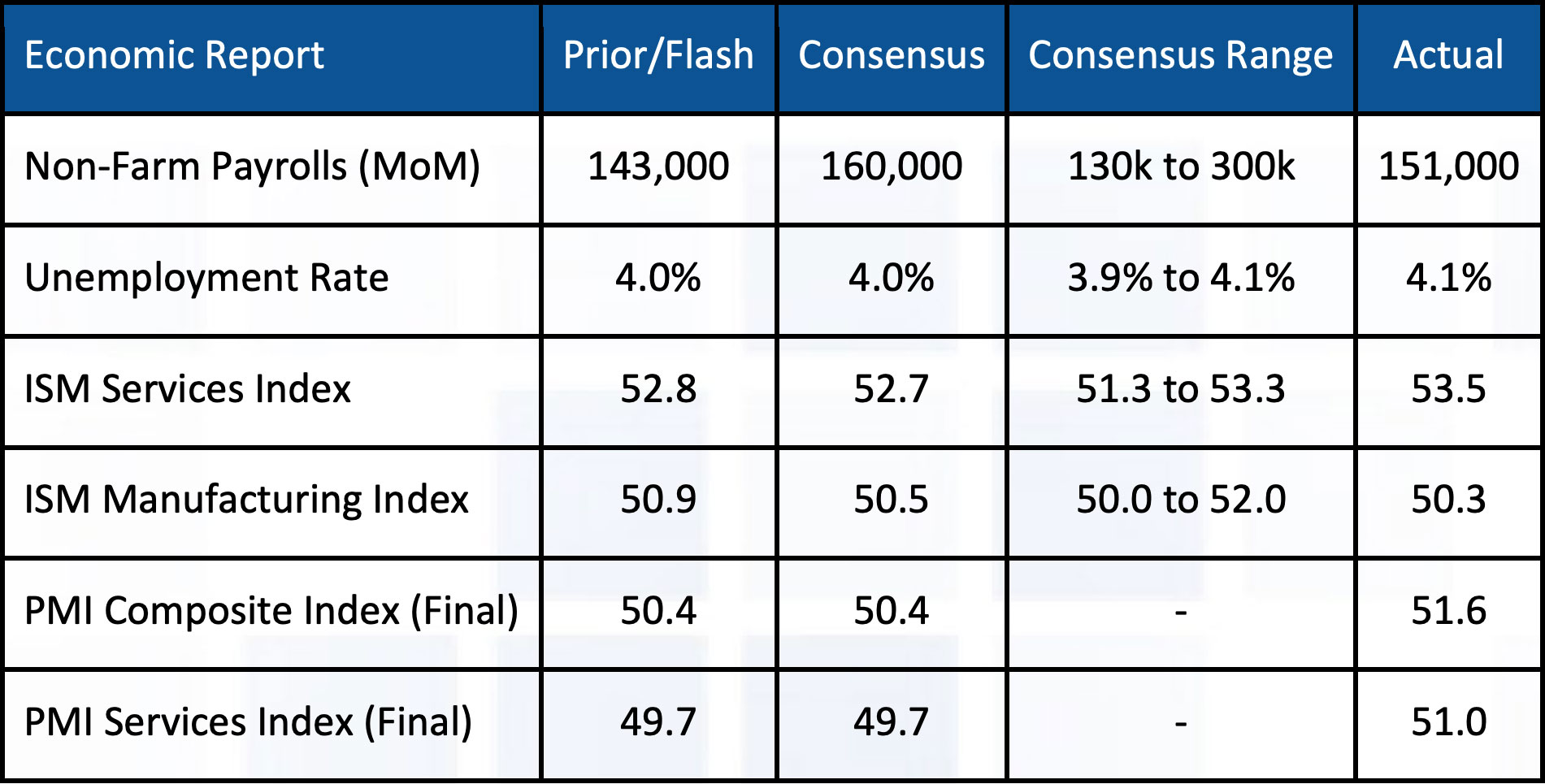

- Last week’s jobs report revealed solid job creation, a slight and unexpected uptick in unemployment to 4.1%, and a decrease in federal workers but not to the extent expected in the March jobs numbers.

- Germany’s response to U.S. policies is gaining market attention with a lift of the debt brake and budget plans to spend $500b on defense alone plus significant infrastructure spending.

- The NPC meeting last week set China’s economic growth target at “around 5%” and fiscal stimulus measures

that met market expectations of an increase but not substantially enough to meaningfully accelerate economic activity. - The FOMC gave a dovish nod toward softening labor markets and inflation dynamics as potentially leading to easing policy but also the need for more clarity on fiscal/trade policy impacts on both. Powell also downplayed recent sentiment and inflation expectation surveys.

- The ECB met market expectations with a 25bp rate cut to take refi and deposit rates to 2.65% and 2.5% respectively

Asset Allocation Narrative

Oversold conditions are mounting in U.S. equity markets but not yet at capitulation levels. Continuation of strong fundamentals and a flip from “spinach” to “candy” from the FOMC or Pennsylvania Avenue should, at some point, get things back on track toward a constructive intermediate term view on risk assets. An exogenous shock or increasing consumer/business sentiment impacting spending remain key risks to our constructive intermediate outlook on equity markets.