Weekly Market Report: March 14th, 2025

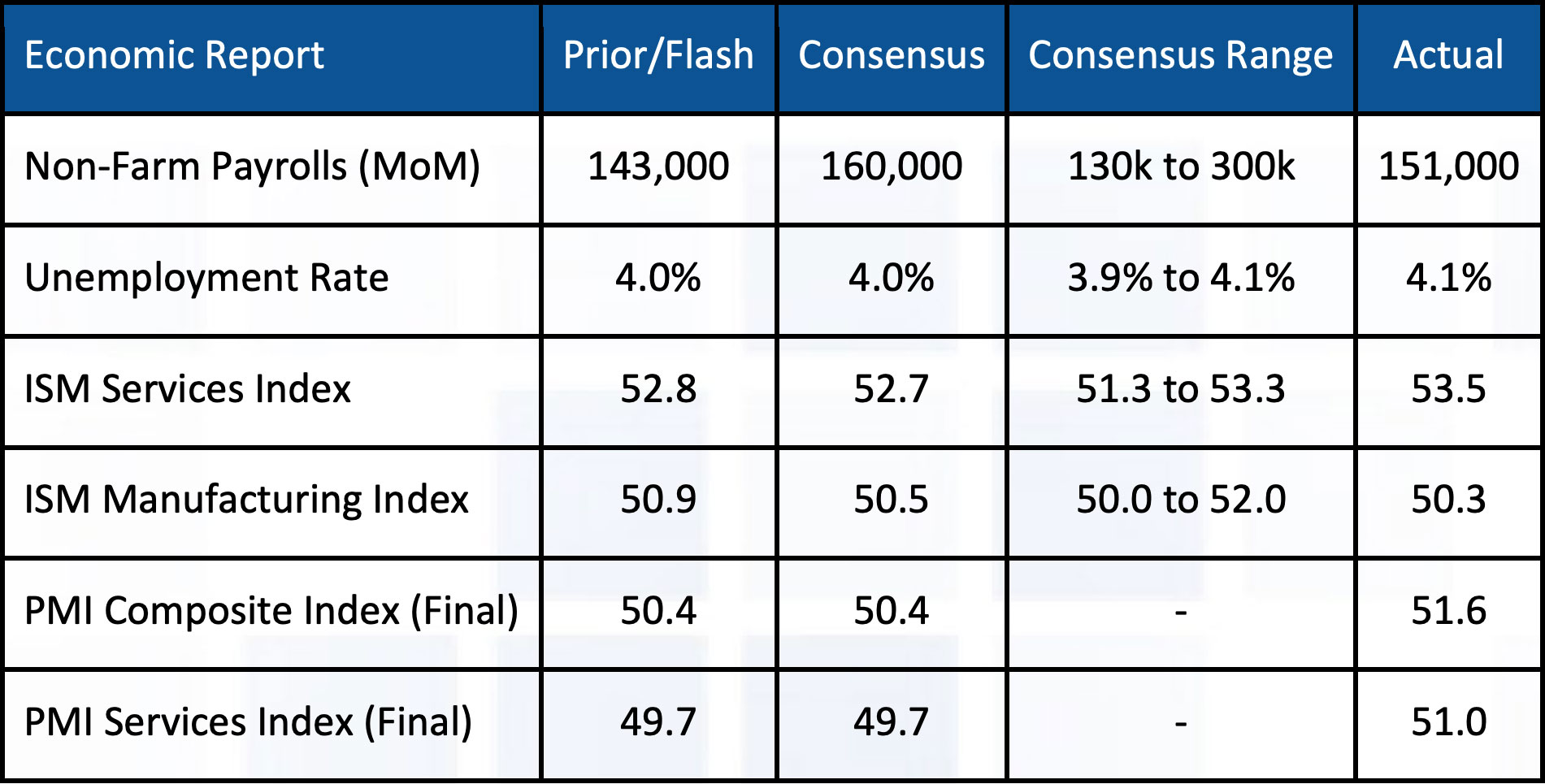

Last week’s economic calendar centered around inflation, labor market, and sentiment but it was policy chaos and uncertainty that has the market’s attention. Despite a nice bounce on Friday, the S&P 500 logged its fourth straight week of losses, officially crossing into correction territory and closing the week down 2.3%. Developed international (-0.85%) and emerging markets (+0.36%) again managed to outperform U.S. markets despite the USD (-0.12%) closing relatively flat on the week. Interest rates remained relatively unchanged while overall commodity markets ended flat with WTI oil closing at $67.18, natural gas falling 6.7%, and upside moves in both industrial and precious metals.

Constructive Asset Allocation Narratives

Cautious Asset Allocation Narratives

This communication is provided for informational purposes only and is not an offer, recommendation or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio.