Retirement Architects Weekly Market Review: August 5, 2022

Weekly Market Report: August 5, 2022

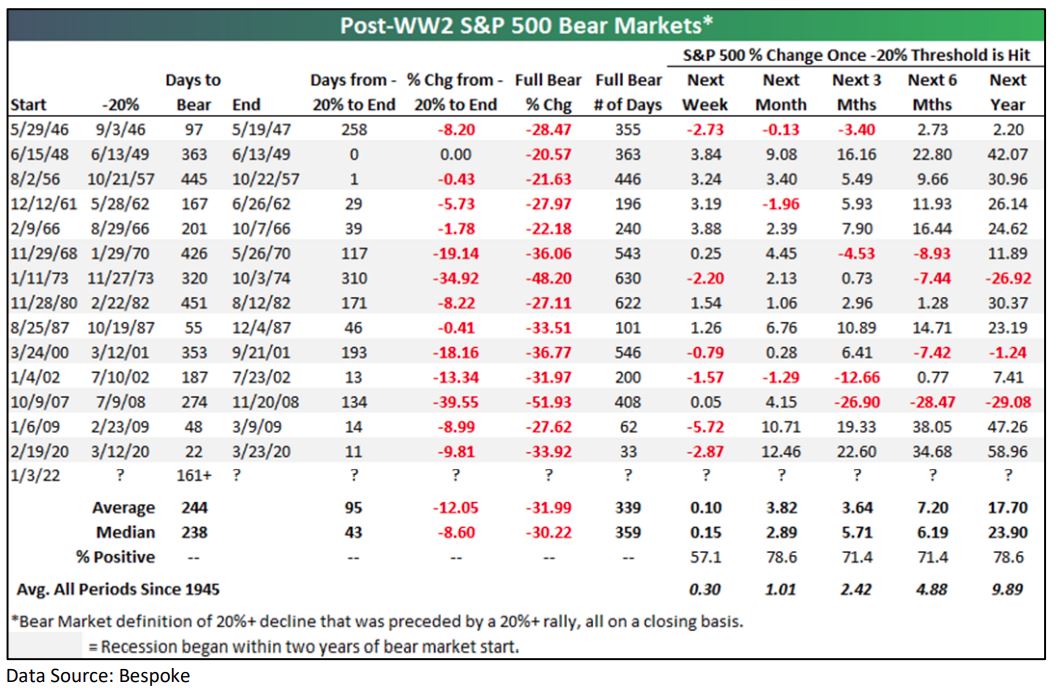

Markets last week continued to digest a heavy slate of corporate earnings and a modest economic calendar punctuated with the July jobs report on Friday. What had been another good week was met with some policy anxiety in response to Friday’s extremely strong jobs report which implied the Fed has more work to do to tame inflation and a hot job market. U.S. equity markets managed to finish up for the week with technology and small caps setting the pace while developed international markets lagged. Interest rates moved sharply higher, in response to increased likelihood of a more hawkish FOMC, with shorter 1yr-5yr rates all increasing nearly 30bps. Commodities fell 6% on the back of a sharp decline in oil prices (-9.74%) to close below $90.

Market Anecdotes

- The move higher in interest rates last week poses a threat to one of the biggest drivers of positive equity market returns we experienced in July. Falling interest rates last month also contributed greatly to the recent decline in the USD.

- Interesting anecdote on the impact of P/E multiple compression on the Russell indices is that the R1000 Value now includes prior growthy names such as Netflix and Facebook while the R1000 Growth included Coca Cola and Procter & Gamble.

- Market reaction to the overwhelmingly robust July jobs report can be categorized as ‘good news is bad news’ with futures pricing in a more aggressive tightening path and a higher terminal rate.

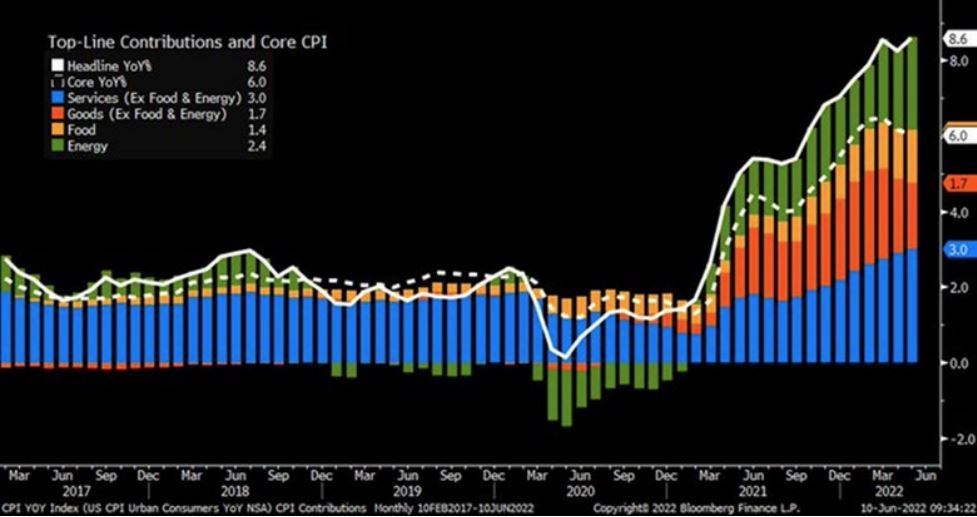

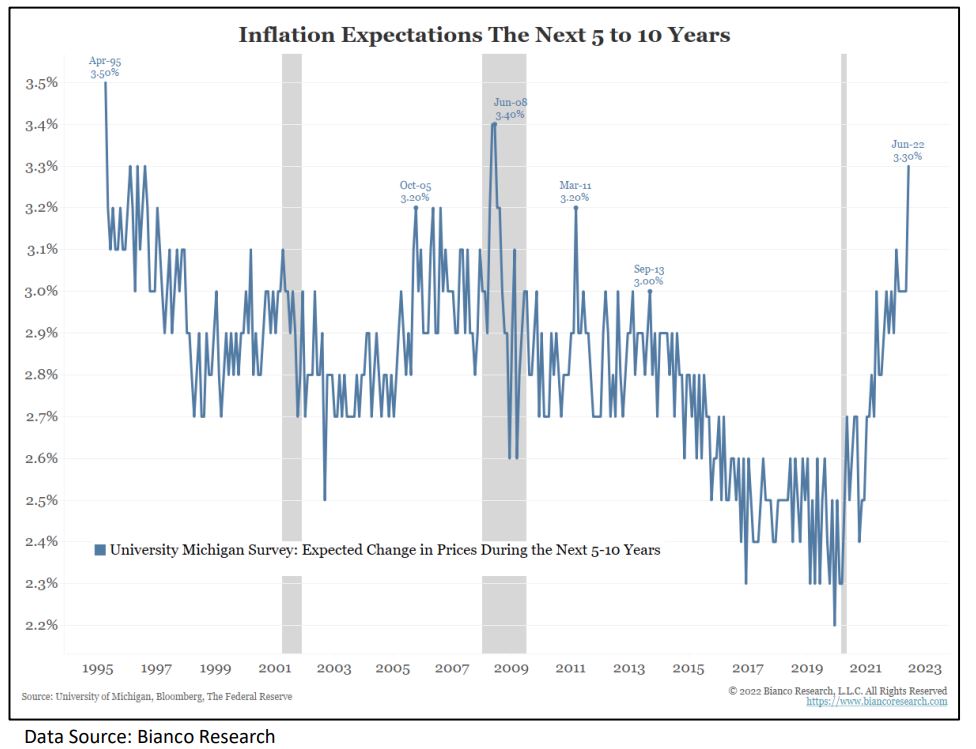

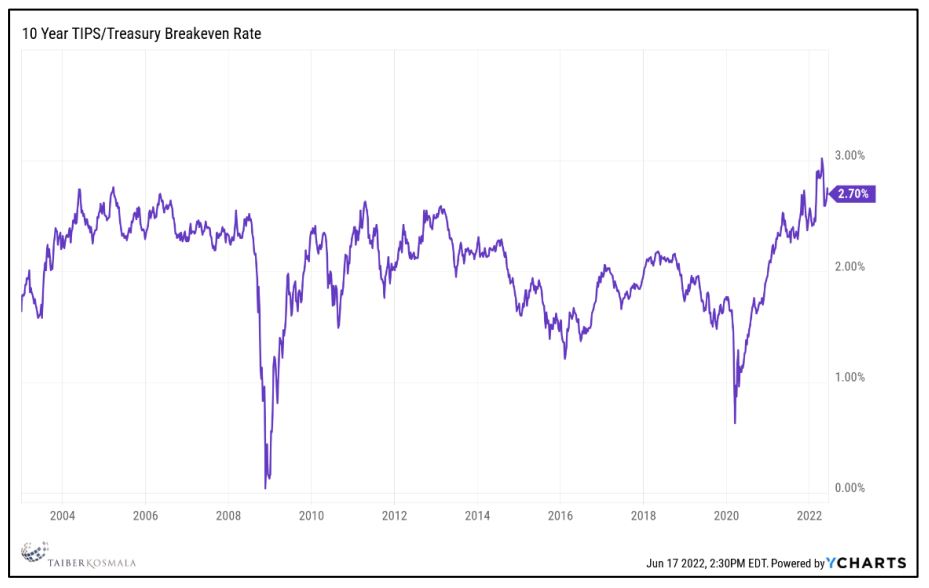

- Inflation data for July and August will ultimately determine the Fed’s path and decision in September but the robust labor market certainly gives them some cushion.

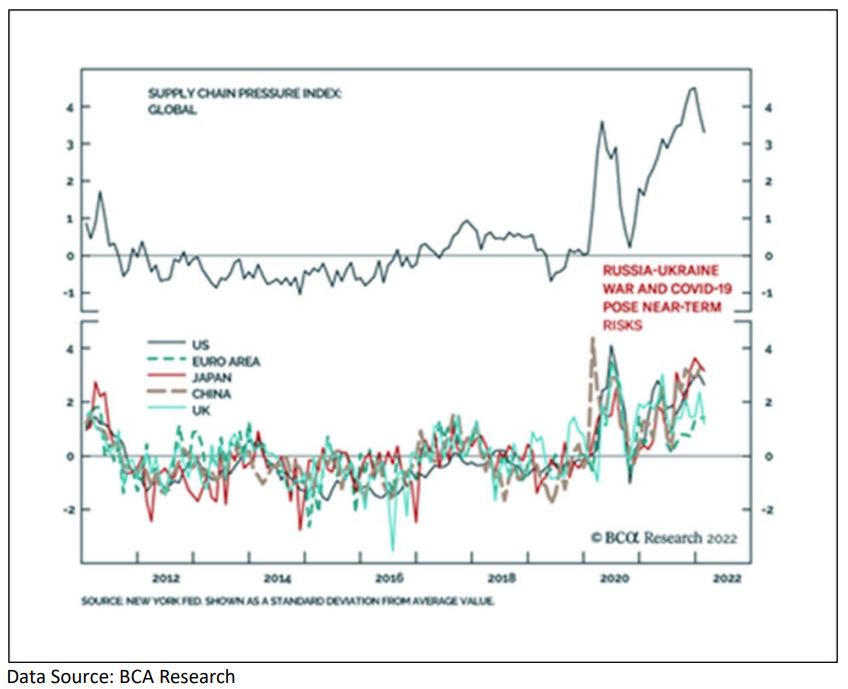

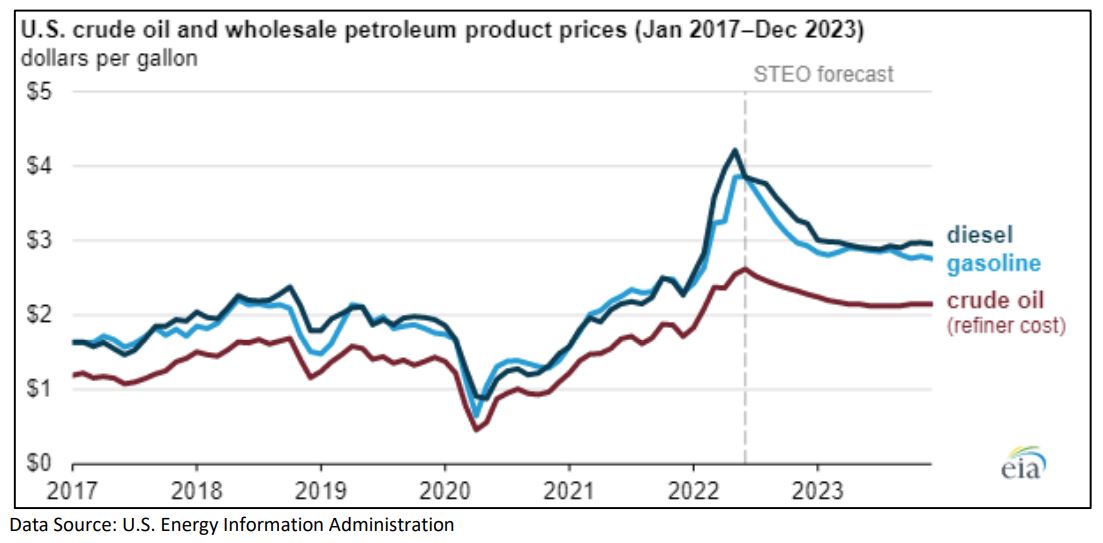

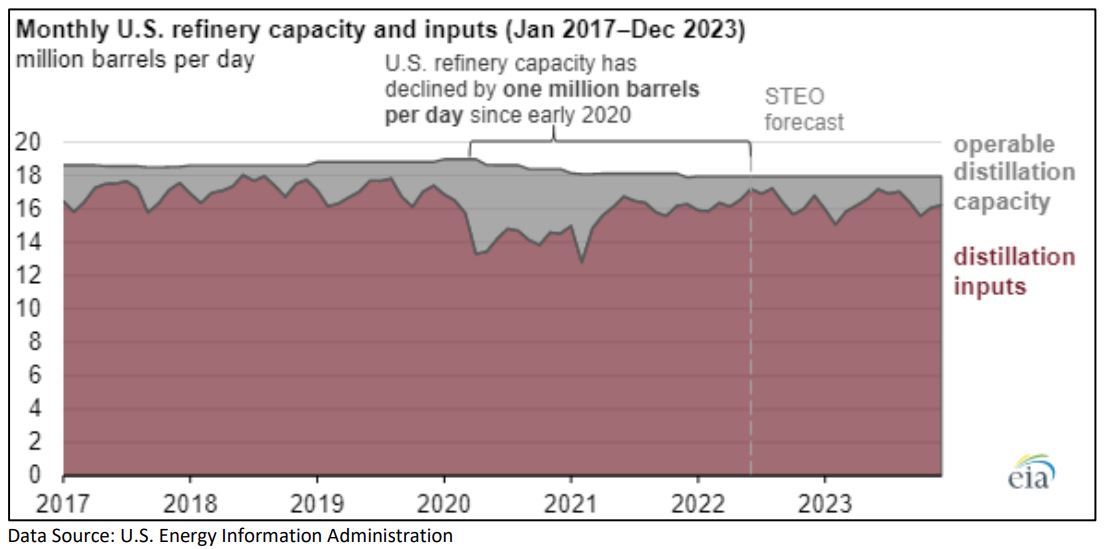

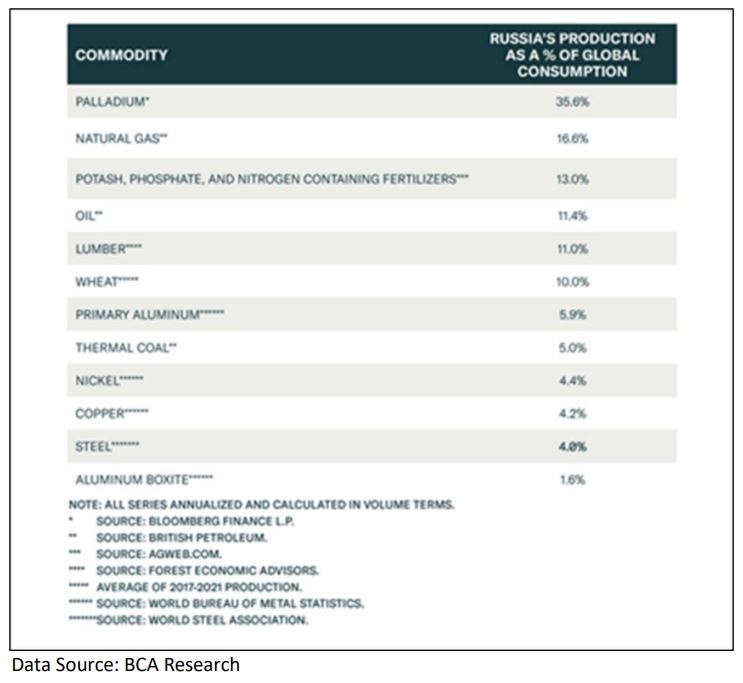

- Global inflation has yet to abate but falling commodity prices (including oil) are providing some hope. Oil’s notable break to the downside is clear but Russia/Ukraine, China zero Covid, and global growth combined translate to extreme levels of uncertainty.

- Gas prices have fallen for over 50 consecutive days and $1.00 from the peak, now around $4.11 per gallon with some areas of the country actually seeing a two handle on a gallon

- How much growth will have to recede to achieve lower inflation is the million-dollar question to which nobody has the answer. Albeit a notably different inflation backdrop, a look at the early 1980’s does little to inspire confidence.

- Over 800 companies have reported 2Q earnings thus far with decent beat rates and underwhelming beat magnitudes. Upward guidance has fallen from 20% to 10% over the past few quarters but 10% is still an impressive number. S&P 500 earnings and revenue growth sit at 6.7% and 13.6%.

- The BCA bull contingency noted the strong possibility of 2Q GDP being revised to positive growth in addition to noting Q1 real GDI increased 1.8% in the first quarter.

- Renmac noted Italy’s fundamental fiscal unsustainability for which the ECB TIP can only buy time. Substantial fiscal reform and/or debt restructuring seem increasingly likely at some point.

Economic Release Highlights

- July’s Employment Situation reported new jobs of 528,000 far exceeding consensus of 250,000, taking the unemployment rate down one tick to 3.5%.

- Labor market participation fell one tick to 62.1% and average hourly earnings came in higher than consensus with growth rates MoM (0.5% vs 0.3%) and YoY (5.2% vs 5.0%).

- The June JOLT Survey revealed 10.698mm job openings, fewer than the 11.0mm forecasted and well below the 11.303mm openings in May.

- The July ISM Manufacturing Index registered 52.8, slightly higher than the consensus forecast of 52.2.

- The July ISM Services Index came in at a robust 56.7, well above consensus of 53.0 and higher than the high end of the forecasted range.